Blogs

Who's liable? A breakdown of personal liability under AML regimes

Breaking down the jargon on AML personal liability

If you’re a director, senior manager or AML/CFT compliance officer in New Zealand, meeting AML requirements isn’t just your business’ obligations - you could be personally liable too, especially if you’re a sole practitioner. But there’s no need to panic. We’ve stripped back the jargon and broken down who could be personally liable and how to stay compliant with confidence in simple steps below.

Who’s liable?

Company directors, Senior managers, AML/CFT compliance officers and, in some cases, employees or agents involved in AML/CFT duties could all be personally liable for violations. If you’re a sole practitioner, you may be conducting several of these duties yourself, or outsourcing tasks to a third party – regardless, the buck stops with you, so it’s important to know your obligations.

We’ve broken down the responsibilities for you below.

Directors of companies, including partners in partnerships, have the ultimate responsibility for ensuring their business complies with the AML/CFT Act. They can be held personally liable for breaches, especially if they are involved in, consented to, or showed willful blindness to non-compliance.

Directors should:

- Ensure the business has a robust AML/CFT programme and risk assessment in place - and that it’s adhered to by all relevant staff.

- Ensure regular reviews are conducted, as well as your annual report filed and an independent audit carried out every three years.

- Appoint a AML/CFT compliance officer and ensure relevant staff are properly trained and vetted.

Senior Managers, including CEOs, CFOs, senior leadership, partners, and anyone with significant influence over the management or administration of the business - also carry personal liability.

The AML/CFT Act and official guidance make it clear that senior managers must:

- Oversee the implementation and effectiveness of the business’ AML/CFT programme.

- Ensure relevant staff (including themselves) receive appropriate AML/CFT training.

- Support the AML/CFT compliance officer and ensure they have sufficient authority and resources.

AML/CFT Compliance Officers must be appointed by every reporting entity, and could be an employee or a partner/external person for sole practitioners. This person is responsible for administering and maintaining the AML/CFT programme and risk assessment.

Compliance officers’ duties include:

- Overseeing day-to-day compliance with the business’ AML/CFT programme and risk assessment.

- Ensuring policies, procedures, and controls are up to date and effective.

- Reporting suspicious activities and prescribed transactions to the NZ Police’s Financial Intelligence Unit (FIU) – see more details in the guide below.

- Preparing annual AML/CFT reports, and facilitating independent audits every three years.

While the main focus is on directors, senior managers, and compliance officers, employees and agents can also be personally liable in certain situations. For example:

- If they knowingly participate in money laundering or terrorist financing.

- If they wilfully fail to comply with AML/CFT obligations (e.g., deliberately not conducting customer due diligence (CDD) checks, or helping to conceal suspicious transactions).

- If they provide false or misleading information to supervisors or the FIU.

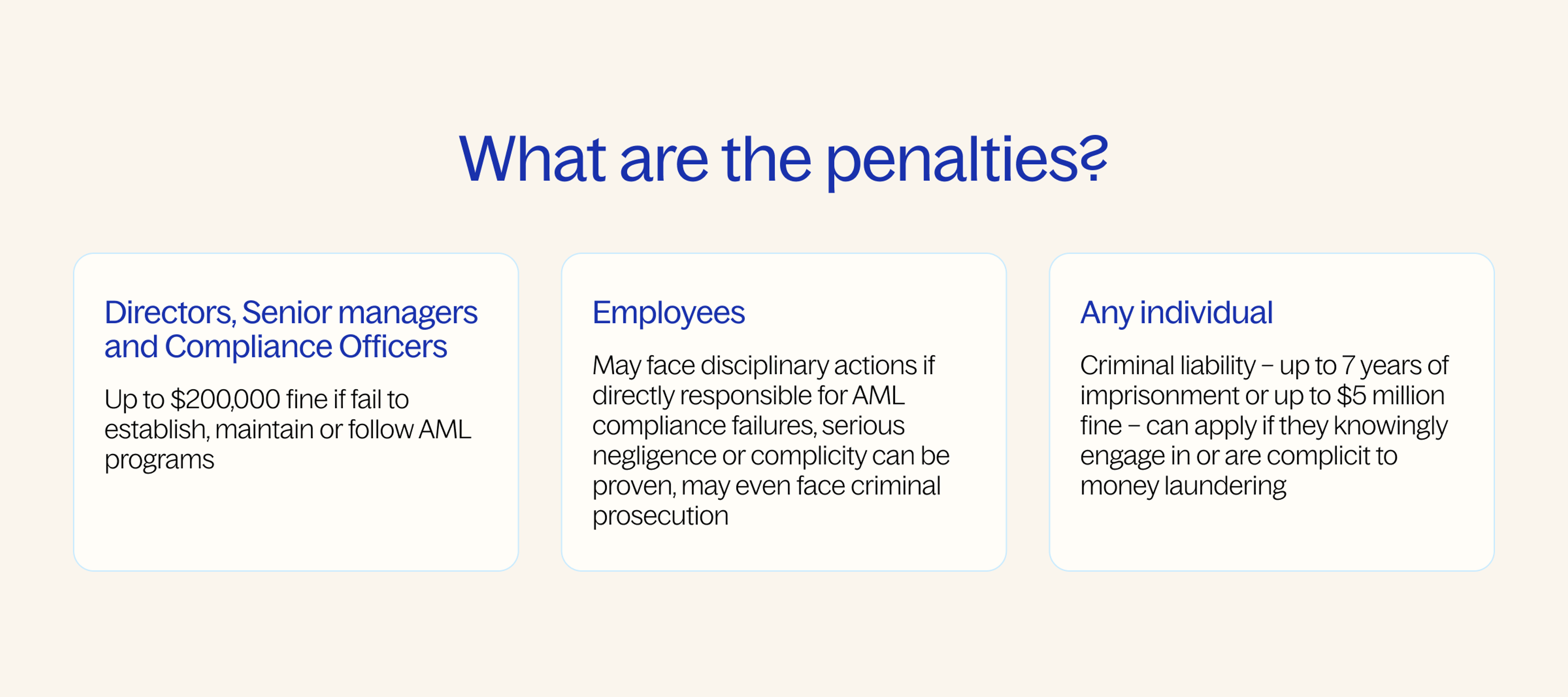

What are the penalties?

In New Zealand, individuals who fail to meet AML regulations can face fines, bans and even criminal charges depending on their role and the severity of the breach.

- Individuals (including Directors, Senior managers, and Compliance Officers) can face civil penalties of up to $200,000 for failing to establish, maintain, or follow an AML/CFT programme. Reporting entities can face penalties of up to $2 million for similar breaches.

- Employees directly responsible for AML compliance failures may also face disciplinary actions, and if complicity can be proven, may even face criminal prosecution.

- Criminal liability can apply to any individual involved if they knowingly engage in or are complicit to money laundering, and can face up to 7 years imprisonment or fines of up to $300,000. Reporting entities can face penalties of up to $5 million.

Fines, bans and warnings are common penalties for procedural failures, while criminal penalties would be more likely to apply to serious cases where an individual has knowingly assisted with or ignored laundering risks.

How to protect yourself from personal liability

You don’t need to be an AML expert. But you do need simple systems that take care of the essentials. Here are the must-haves:

- A clear AML/CFT programme: relevant to your business and up to date.

- Reliable CDD and risk assessment processes: for every client, every time.

- Proper reporting: suspicious transactions, prescribed transactions, and annual AML reports.

- Secure record-keeping: stored for 7 years and audit-ready.

APLYiD handles your AML compliance from start to finish — ID verification, CDD, risk assessment, and record keeping — with no admin headaches and no training needed.

Let APLYiD take the pressure off

At APLYiD, we help you get compliant and stay that way — without the headaches.

- No training needed. Everything’s automated and guided.

- No unnecessary complexity. Just one self-serve platform for all AML tasks.

- No admin overload. ID verification, CDD, risk assessments and record-keeping — all sorted.

- No gaps in compliance. Our platform keeps you covered, even when regulations change.

Whether you're running a solo practice or managing a small team, APLYiD helps take the guesswork out of compliance so you can focus on what you do best.