No-nonsense AML platform for your business

APLYiD makes AML compliance so smooth you’ll hardly notice it.We’re partnered with 1,000s of businesses across the world

Effortless

AML compliance,

no hassle

No Hassle

How APLYiD works

Our people-friendly AML platform lets you manage all your AML due diligence, for every client - from start to finish.

Onboard

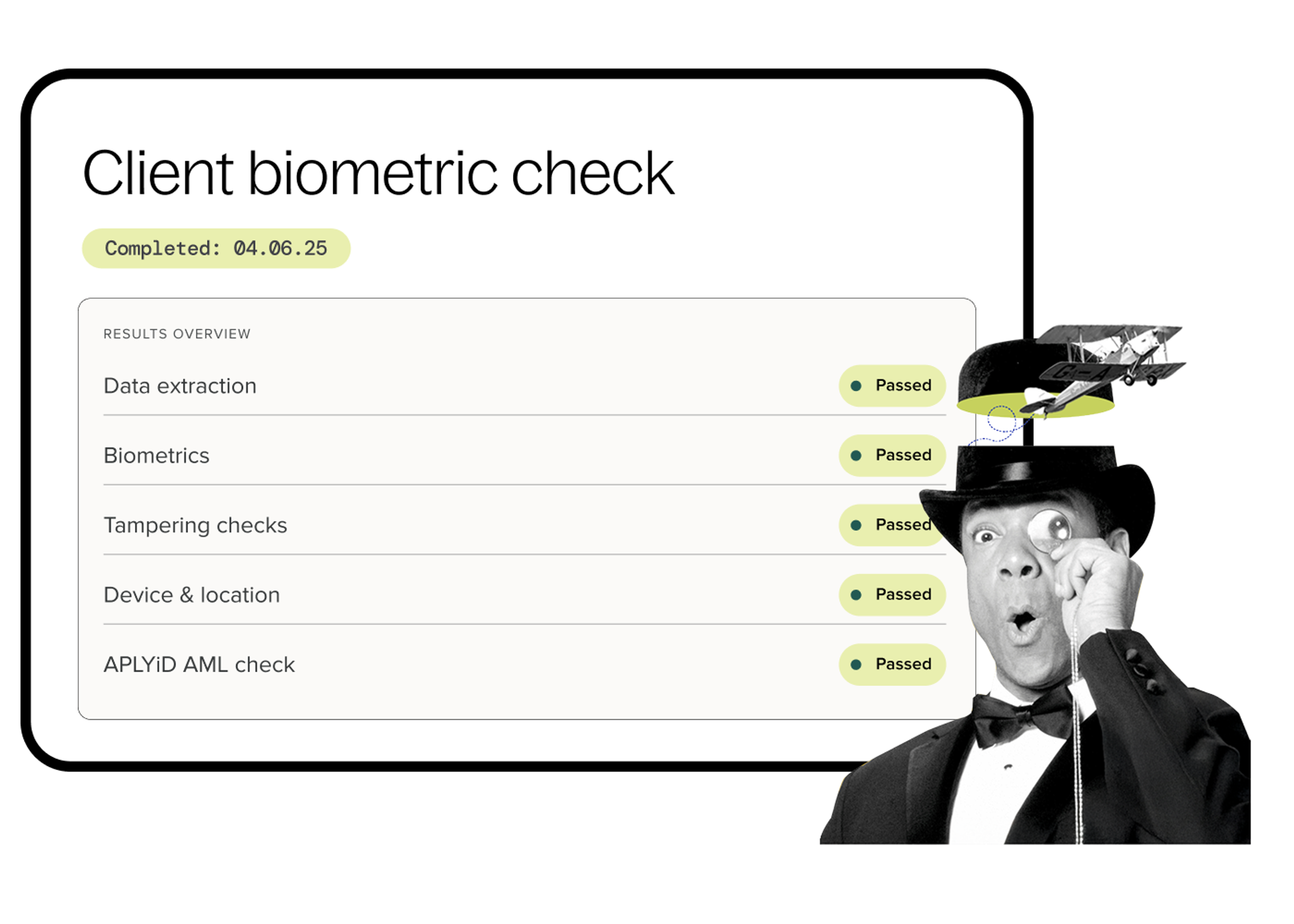

Request the right documents every time with guided document collection.Verify

Verify and easily re-verify clients using the relevant biometric AML, KYC, and KYB checks.Manage

View and manage all AML activities and risks — for every client — in one place.Monitor + Relax

Set risk levels, automate review alerts and set up ongoing monitoring.No Problems

Client-friendly compliance

Keep your clients on side and increase the chance of success with the smoothest onboarding flows out there. Fast, automated biometric AML checks with 94% success rates — in less than 90 seconds.

"APLYiD makes compliance simple and stress-free"

Gabriella SandovalOperations Manager, Dawn Sandoval Residential

"Great experience - operations now hours, not days"

MatthewConveyancing Manager, Assured Conveyancing Ltd

Facts

Facts70%

less paperwork

We’re a fully-accredited AML platform

No Worries

Onboard any client Stay 100% compliant

Our platform will always keep you ahead of the latest global regulations.

no commitment

Get started today with help on hand

You can start using APLYiD straight out the box – no delays, no contracts, no headaches. Prefer a demo? Need a hand? Our support team is ready when you are.

01.

01.No contracts

02.

02.Start in minutes

03.

03.Human support on call

WHY APLYiD?

We take the complexity out of compliance

Unlike some over-complicated AML software, we offer a streamlined platform especially designed for small to medium-sized enterprises who want an easy-to-manage solution that's fast and free to start.

Backed by the reassurance of real and human support on our free support line to troubleshoot for your team and your clients.

Learn more about usAML compliance you can turn on today

Get started yourself with our cloud-based, self-serve platform.

Book a demoFree trialWant to know more? Visit our Product page