Blogs

Get AML audit ready now, save yourself the headache later

With the AUSTRAC Tranche 2 Rules rolling out next year, staying prepared for an AML audit is more important than ever. Whether you’re already regulated or about to be captured under the new rules, here’s what you need to know about AML audit requirements and how to stay one step ahead.

Why AML auditing matters

In a nutshell, every reporting entity in Australia must have a compliant AML/CTF program, report suspicious matters, keep records for seven years, and undergo independent audits. AUSTRAC can (and does) inspect programs, and you don’t want to get hit with a penalty for non-compliance!

The first audits may be a while away, but having the right technology partner, like APLYiD, can help you track and store things correctly from the start, saving you a ton of admin later. We can help you cut the complexity and deliver secure digital onboarding, AML checks and record keeping. Stay compliant and audit ready with our easy-to-use, people-friendly software.

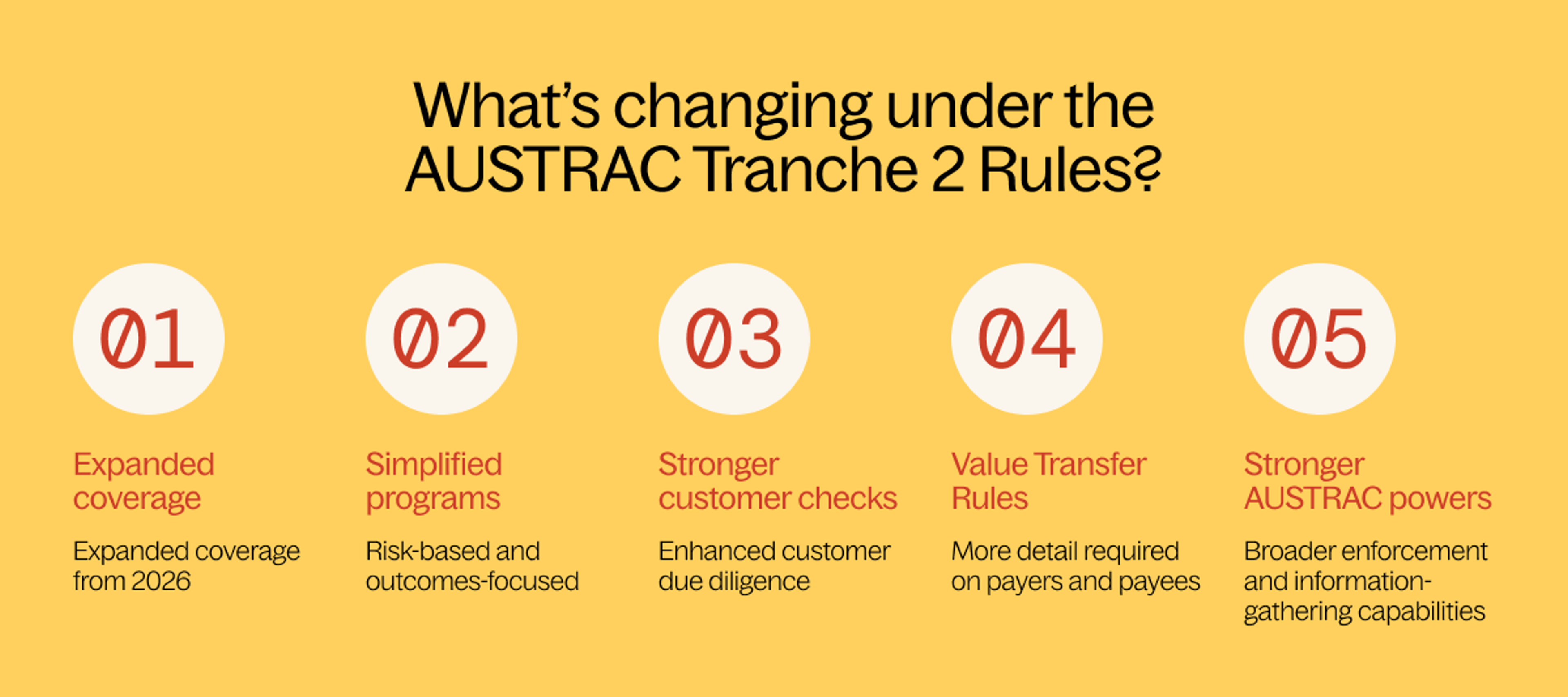

What’s changing under the AUSTRAC Tranche 2 rules?

- From 2026 there will be expanded coverage. Real estate, lawyers, accountants, trust services, dealers in precious metals/stones and more virtual asset providers will be regulated under the new rules.

- No more “Part A” and “Part B”, programs will be simplified and must be risk-based and outcomes-focused.

- Stronger customer checks will be expected. This includes enhanced customer due diligence (CDD) for domestic politically exposed persons (PEPs) and higher-risk customers.

- In money and crypto transfers, more detail will be required on payers and payees under the Value Transfer Rules to help combat financial crime.

- Stronger AUSTRAC powers means there will be broader enforcement and information-gathering capabilities. Get ready now with APLYiD and save yourself the stress down the line.

- What stays the same? Suspicious matter and threshold transaction reporting, employee training, compliance officer requirement, and the seven-year record keeping rule.

- You can read more about the changes on AUSTRAC's website here.

These changes might sound complicated, but it doesn’t have to be. APLYiD helps you stay compliant with a simple, audit-friendly platform that manages your client onboarding and customer verification from start to finish.

Your AML audit-ready checklist

- Make sure you confirm you’re enrolled or registered with AUSTRAC.

- Develop a risk-based, AML/CTF programme tailored to your business and ensure its signed-off by management.

- Ensure you have regular AML auditing by a qualified independent party not involved in program design.

- Do your customer due diligence: verify customers, beneficial owners, and apply enhanced checks for higher risk. With APLYiD, this process is made simple with our instant biometric verification and source-of-funds checks.

- Report any suspicious matter and ensure threshold transaction reports are lodged on time.

- Retain all records for at least seven years. APLYiD’s digital records can give you a clear, auditable trail.

- Ensure you have ongoing staff training, board oversight and clear policies.

Auditing red flags

- Leaving audit prep till crunch time can grind your business to a halt while you scramble for documents. Get the right AML platform in place from day one and make audits a breeze.

- Storing documents yourself is a risky move. System changes, hardware failures or file mismanagement could derail your compliance. APLYiD keeps everything you need secure, accessible, and audit-ready.

- If your team is using different methods or missing crucial steps for ID checks you’re exposed. APLYiD standardises verification with compliant workflows.

- Staff turnover is inevitable. If all your compliance knowledge walks out the door, business continuity is at risk. APLYiD’s people-friendly platform helps new team members pick up AML processes without missing a beat.

Stay audit-ready with APLYiD

Putting the right technology in place can help you get ahead of the changes and reduce the admin load on your staff. APLYiD offers no nonsense AML compliance – stay compliant with confidence, from onboarding and customer due diligence right through to audits and record-keeping